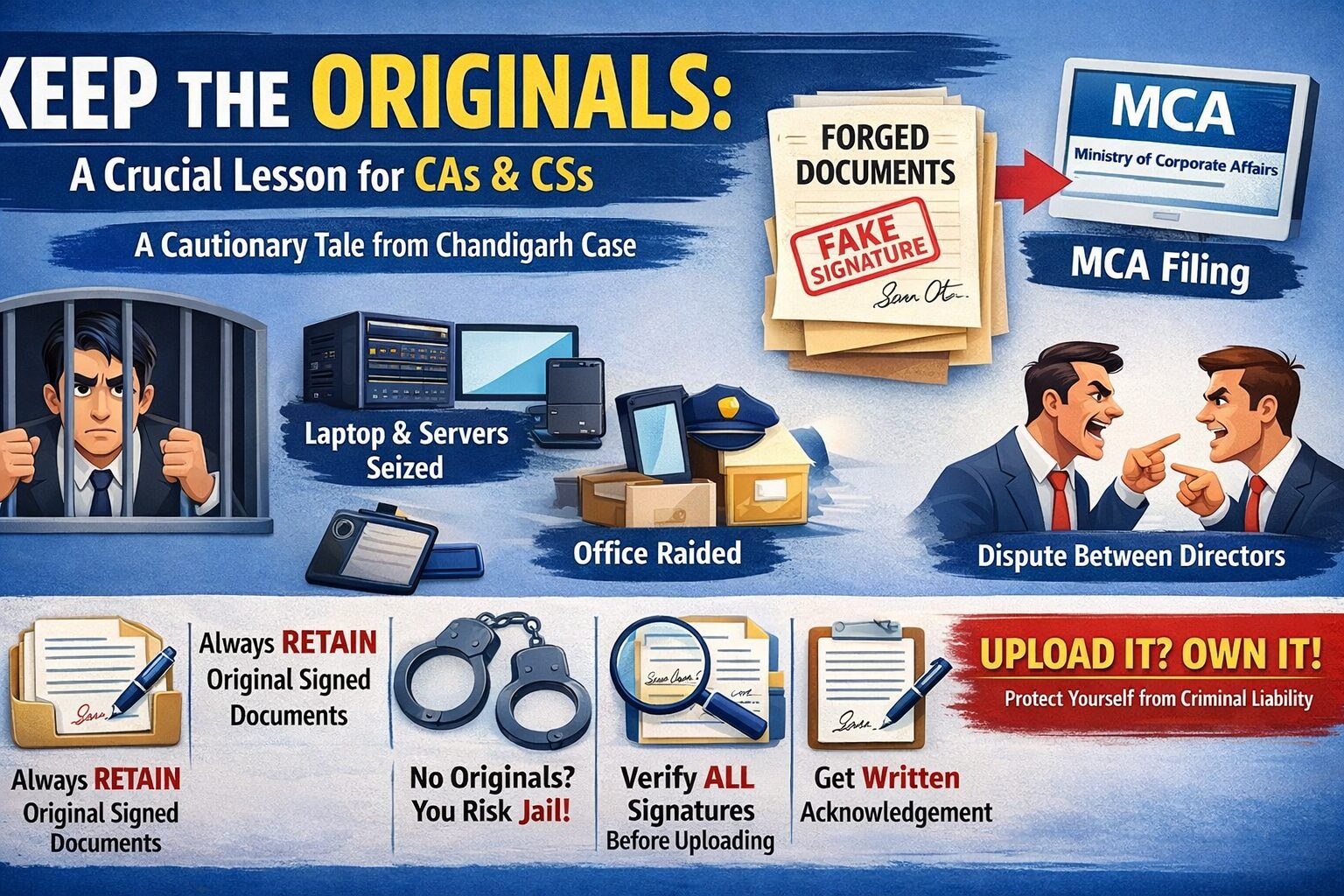

A recent criminal prosecution from Chandigarh serves as a serious wake-up call for Chartered Accountants (CAs) and Company Secretaries (CSs) across India.

The episode underscores a hard but necessary professional lesson: never upload documents on the MCA or any Government portal unless the originals, duly signed by all directors, are physically and permanently retained with you.

This article examines the incident, the legal reasoning adopted by the authorities, and the crucial compliance takeaways for professionals.

Table of Contents

Toggle

The Incident in Brief

In a company run by two friends-turned-partner directors, a financial dispute arose between them. One director alleged that:

Share allotment and related statutory forms were uploaded on the Ministry of Corporate Affairs portal,

His signatures on the documents were forged, and

The CA who uploaded the forms was complicit in filing forged documents.

The matter quickly escalated into a criminal prosecution.

The Shocking Turn of Events

During investigation:

The CA was asked to produce the original documents bearing signatures of all directors.

The CA took the defence commonly adopted in practice:

“Originals are returned to the directors after filing. We never retain them permanently.”

This defence did not find favour with the investigating authorities or the court.

Consequences faced by the CA

Judicial remand for over one month

Seizure of laptop, servers, mobile phone and even car

Office searches conducted solely to recover the ‘original signed documents’

The clear presumption adopted was:

If documents were uploaded, the professional must have had the originals in his custody.

Only after prolonged incarceration was the CA released on bail.

The Legal Assumption That Changed Everything

The authorities proceeded on a simple but powerful premise:

A professional who uploads statutory forms is expected to have verified, possessed, and retained the original signed documents.

Failure to produce originals led to:

Suspicion of professional complicity

Loss of credibility of oral explanations

Personal criminal exposure, not merely professional liability

This is a dangerous shift from theoretical compliance to evidentiary accountability.

Why This Case Is a Turning Point for CAs & CSs

Traditionally, many professionals believed:

Originals belong to the company

Professionals are only facilitators of filing

Digital filing does not require physical custody of records

This case decisively challenges that belief.

From an enforcement perspective:

Uploading = authentication

Authentication = responsibility

Responsibility = custody & preservation of originals

Key Compliance Lessons for Professionals

1. Never upload without originals

Do not upload any form, return or attachment unless:

Originals are physically signed

Signatures of all required directors / signatories are present

Documents are verified personally

2. Retain originals permanently

Maintain:

Physical files of signed originals, or

Properly indexed, scanned copies backed by physical originals

Treat these records as defensive evidence, not clerical paperwork.

3. Stop relying on “common practice”

Statements like:

“Originals are returned”

“This is how everyone does it”

“Professionals are not required to keep originals”

have no value in criminal investigation or court proceedings.

4. Obtain written acknowledgements

Where originals must be returned:

Take a written acknowledgment from all directors

Clearly record that filing was done after verification

Even this may not be foolproof—but it is better than nothing.

A Word of Caution for Young Professionals

This incident shows that:

Professional negligence can quickly become criminal liability

Good faith explanations may not protect you

Investigation agencies look for documents, not traditions

In today’s enforcement-driven regulatory environment, procedural shortcuts are personal risks.

Conclusion

The Chandigarh prosecution delivers a clear and uncomfortable message:

If you upload it, you own the responsibility—legally, professionally, and personally.

For CAs and CSs, retaining duly signed original documents is no longer optional or “best practice”.

It is a shield against criminal prosecution.

Compliance today is not about convenience. It is about survival.

Note : This article is intended for professional awareness and does not constitute legal advice.