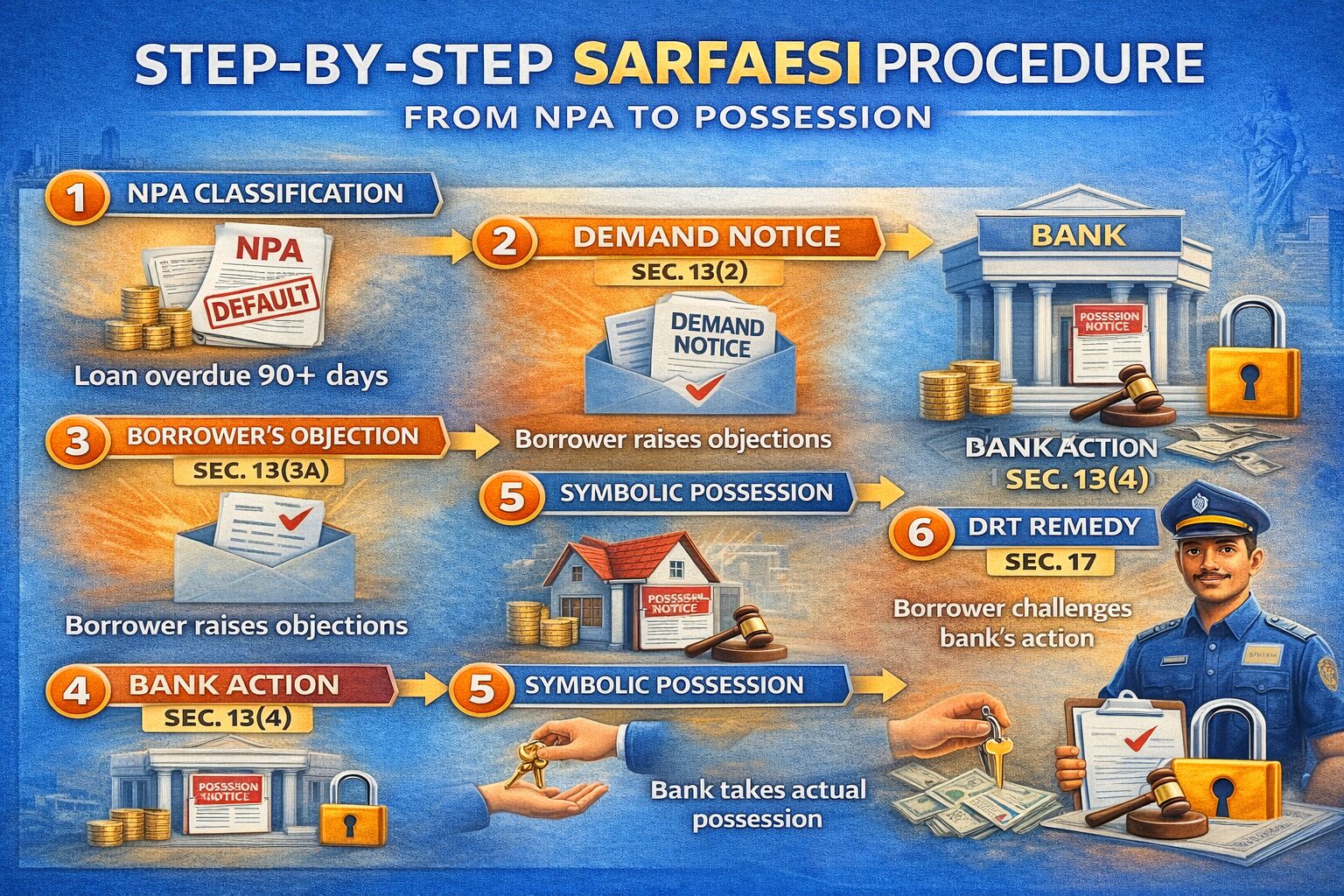

A SARFAESI demand notice under Section 13(2) grants borrowers 60 days’ time to clear outstanding dues or raise objections. Many borrowers believe that nothing serious happens immediately after this period. In reality, the expiry of 60 days is a legal turning point that allows banks to initiate coercive enforcement measures.

This article explains what legally happens after the 60-day SARFAESI notice period ends, and what borrowers should do at each stage.

Table of Contents

ToggleMeaning of the 60-Day Period Under SARFAESI

The 60-day period is a statutory cooling-off period provided to borrowers to:

Repay the dues, or

Raise objections under Section 13(3A), or

Resolve disputes before enforcement begins

⚠️ During this period, banks cannot take possession or sell assets.

Scenario 1: Borrower Pays the Dues Within 60 Days

If the borrower:

Pays the entire outstanding amount, or

Settles the account as agreed

👉 SARFAESI proceedings come to an end.

The bank cannot proceed under Section 13(4).

Scenario 2: Borrower Raises Objections (Section 13(3A))

If objections are raised:

The bank must consider them

A reasoned reply must be given

If objections are accepted, proceedings stop.

If objections are rejected, the bank may proceed after expiry of 60 days.

Scenario 3: Borrower Does Nothing (Most Common Situation)

If the borrower:

Does not pay

Does not file objections

Ignores the notice

👉 The bank becomes legally entitled to invoke Section 13(4) of the SARFAESI Act.

What the Bank Can Do After 60 Days – Section 13(4)

After expiry of 60 days, the bank may take one or more of the following measures:

1. Take Possession of the Secured Asset

Symbolic possession of immovable property

Possession notice affixed on the property

Publication in two newspapers

This is the most common next step.

2. Take Over Management of the Secured Business

Applicable mainly in:

Industrial or commercial loans

3. Appoint a Manager

A manager may be appointed to manage the secured asset.

4. Proceed for Sale of the Secured Asset

Auction process may begin after possession is taken.

Symbolic Possession vs Physical Possession

Symbolic possession

Legal control is taken, borrower may still occupy propertyPhysical possession

Actual dispossession, often with police assistance

Physical possession usually follows Section 14 proceedings.

Borrower’s Remedy After 60 Days – Section 17 (DRT)

Once action under Section 13(4) is taken, borrowers get a statutory right to approach the Debt Recovery Tribunal (DRT).

Key Points

Application must be filed within 45 days

DRT can:

Grant interim stay

Set aside illegal possession

Restore possession

⚠️ Limitation is strictly enforced.

Common Misconceptions After 60 Days

❌ Bank must issue another notice

❌ Court permission is mandatory before possession

❌ Borrower has no remedy

✔ In reality:

No fresh notice is required

Possession can be taken directly

DRT remedy becomes available

Illegal Actions Even After 60 Days

Even after expiry of 60 days, SARFAESI action is illegal if:

NPA classification is defective

Objections were not considered

Agricultural land is involved

Notice was not properly served

Section 14 order is mechanical

Procedural compliance remains mandatory.

Practical Advice for Borrowers

After receiving a SARFAESI notice:

Do not wait till day 60

File objections early

Prepare for DRT action

Seek legal advice before possession

Act immediately upon possession notice

Delay after 60 days often results in loss of valuable rights.

Role of an Advocate After 60 Days

An advocate can:

Challenge possession proceedings

File DRT application within limitation

Seek interim stay

Examine procedural violations

Prevent auction of property

Conclusion

The expiry of the 60-day SARFAESI demand notice period marks the transition from warning to enforcement. Borrowers who fail to act within this window expose themselves to possession and auction proceedings. However, even after 60 days, illegal SARFAESI action can be challenged effectively—provided borrowers act promptly and correctly.

FAQs

Q. Can the bank take possession immediately on the 61st day?

Yes, if statutory requirements are satisfied.

Q. Can borrowers approach DRT before possession?

No. DRT remedy arises only after Section 13(4) action.

Q. Is physical possession taken immediately after 60 days?

Usually symbolic possession is taken first.