Table of Contents

ToggleIntroduction

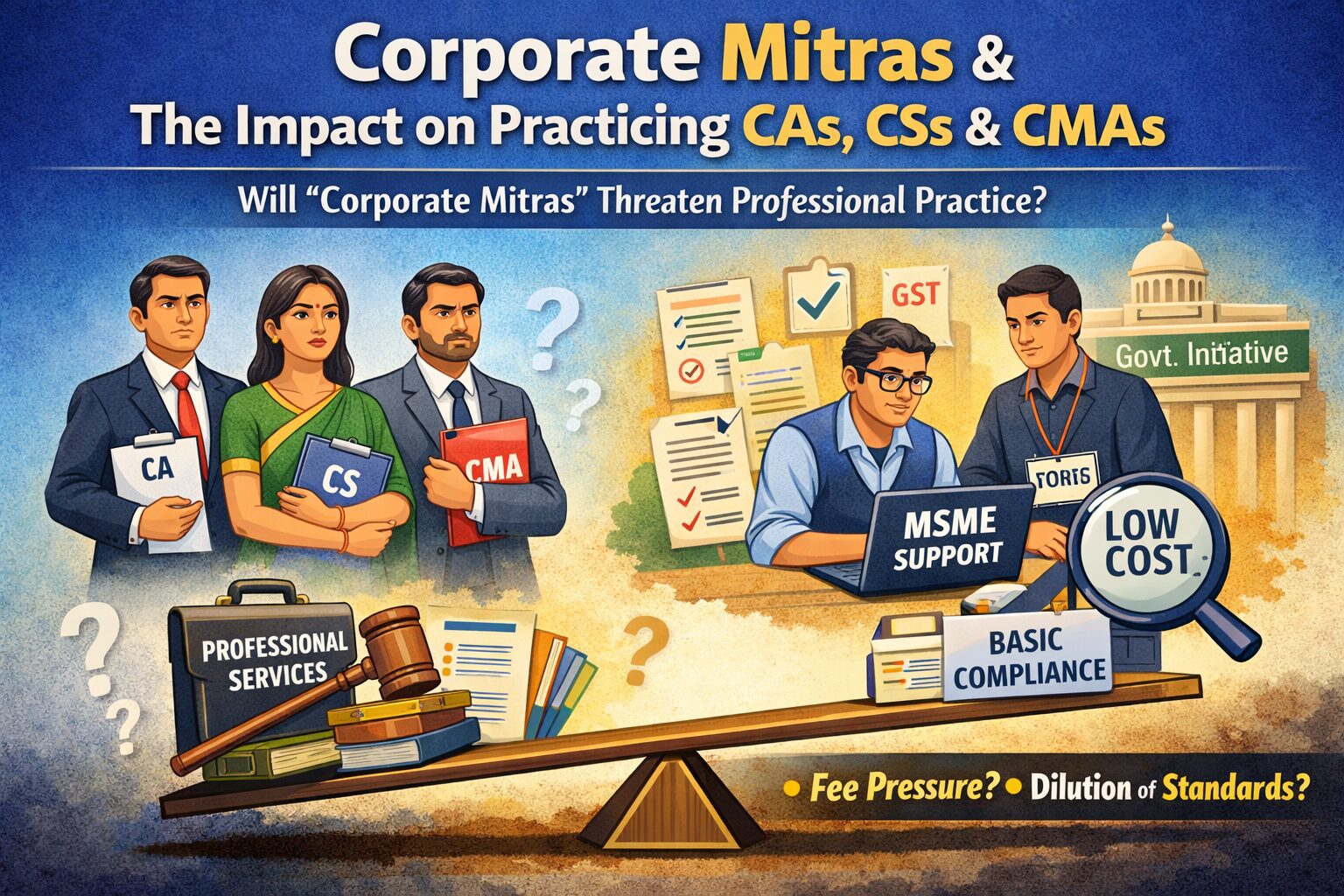

The Union Budget 2026–27 has proposed the creation of a new cadre of trained paraprofessionals, termed “Corporate Mitras”, aimed at supporting Micro, Small and Medium Enterprises (MSMEs) in meeting their compliance and regulatory requirements. The stated objective is to reduce the compliance burden on MSMEs, improve ease of doing business, and widen formalisation of small enterprises.

While the intention appears well-meaning, the proposal has triggered serious apprehension among practicing Chartered Accountants (CAs), Company Secretaries (CSs), and Cost and Management Accountants (CMAs). These professionals have traditionally been the backbone of MSME compliance in India. The key question therefore arises:

Does the Corporate Mitra framework pose a threat to practicing professionals, or does it merely reshape the compliance ecosystem?

Understanding the “Corporate Mitra” Concept

As per the Budget announcement, Corporate Mitras are envisioned as:

Trained paraprofessionals

Providing hand-holding support to MSMEs

Assisting in routine and basic compliance requirements

Acting as a bridge between small businesses and the regulatory system

Though detailed guidelines are awaited, it is clear that Corporate Mitras are not full-fledged professionals regulated by statutory councils, but individuals trained through government-supported programs.

Traditional Role of Practicing CAs, CSs and CMAs in MSME Sector

For decades, MSMEs have relied heavily on practicing professionals for:

Incorporation and structuring

ROC, GST, Income-tax and labour law compliances

Audit, certification and attestation

Advisory on governance, funding and restructuring

Representation before authorities

For many small and mid-size firms of CAs, CSs and CMAs, MSME compliance work forms a significant portion of recurring revenue.

Key Concerns for Professionals in Practice

1. Erosion of Entry-Level and Routine Work

Routine compliance work—such as form filing, returns, basic documentation and reminders—has traditionally been the starting point of professional engagement with MSMEs.

If Corporate Mitras are authorised to handle:

Basic filings

Periodic returns

Documentation support

then entry-level compliance work may shift away from professionals, especially in cost-sensitive MSMEs.

2. Fee Pressure and Commoditisation of Compliance

With the availability of government-supported paraprofessionals:

MSMEs may expect lower professional fees

Compliance may be perceived as a low-skill, low-value activity

Professionals may face pressure to reduce pricing to compete

This could accelerate the commoditisation of compliance services, particularly in Tier-II and Tier-III cities.

3. Risk of Dilution of Professional Standards

Statutory professionals are bound by:

Rigorous education and examinations

Ethical codes and disciplinary mechanisms

Professional liability and accountability

Corporate Mitras, unless similarly regulated, may:

Lack depth of legal understanding

Commit procedural errors

Expose MSMEs to compliance risks

Ironically, errors by Mitras may eventually land back on professionals for rectification, increasing liability without corresponding remuneration.

4. Impact on Small and Sole Practitioner Firms

Large firms may pivot easily towards:

Advisory

Litigation

Transaction support

However, small and sole practitioners, especially those primarily serving MSMEs, are likely to feel the maximum impact, as:

Their practice is compliance-heavy

Margins are already thin

Client retention depends on end-to-end service offerings

Is It a Complete Threat? A More Balanced View

Despite concerns, the proposal does not necessarily spell doom for professionals.

1. Boundary of Authority Still Lies with Professionals

Certain functions cannot be outsourced to paraprofessionals, such as:

Statutory audits

Certifications and attestations

Legal opinions

Representations before tribunals and authorities

The final responsibility and sign-off will continue to rest with licensed professionals.

2. Potential to Act as an Extended Workforce

If structured wisely, Corporate Mitras could:

Act as compliance facilitators under professional supervision

Reduce clerical and follow-up burden

Improve compliance reach in underserved areas

Professionals could leverage Mitras as execution support, while focusing on higher-value work.

3. Shift from Compliance to Advisory

The development reinforces an unavoidable reality:

Pure compliance work is no longer the future of professional practice.

Professionals who evolve into:

Strategic advisors

Governance consultants

Transaction and restructuring experts

Risk and compliance managers

will remain indispensable.

Way Forward for Practicing Professionals

1. Upskilling and Specialisation

Professionals must move beyond routine filings into:

Complex advisory

Sector-specific expertise

Litigation and representation

2. Client Education

MSMEs must be educated that:

Compliance is not just filing

Errors can lead to penalties, disqualification and prosecution

Professional oversight is non-negotiable

3. Engaging with Policymakers

Professional institutes must:

Seek clarity on scope of Corporate Mitras

Ensure no overlap with regulated professional functions

Advocate accountability and supervision mechanisms

Conclusion

The introduction of Corporate Mitras under Union Budget 2026–27 represents a structural shift in the compliance ecosystem, not an outright replacement of professionals. While it does pose challenges—especially for routine compliance-centric practices—it also presents an opportunity for transformation.

Practicing Chartered Accountants, Company Secretaries and Cost Accountants who adapt, upskill and reposition themselves as trusted advisors rather than mere compliance vendors will continue to play a central role in India’s MSME growth story.

In essence, the proposal is less a threat to the profession and more a wake-up call for its evolution.